XE Trade review: CAD-USD online currency exchange

First published on April 14, 2012

XE Trade is an online currency exchange service by the currency rate information site xe.com. It can be used for business and personal reasons, to exchange money between your own accounts or to send money to people in foreign countries and foreign currencies. This review is from the standpoint of a Canadian buying US dollars for personal use.

Why use XE Trade

The premise is that XE Trade would offer better rates and be more convenient than a bricks and mortar money changer, such as Vancouver Bullion Currency Exchange or Benny Lee & Co.

Regarding rates, this is true most of the time. I’ve seen XE Trade offer rates that are between 0.7 and 2.0 cents off the mid-rate listed on xe.com, with a tendency for the higher range on the weekend. This should be always better than everyday bank exchange rates and most of the time better than the other currency exchange specialists. There are no transaction fees.

The requirement to use XE Trade is that you have CAD and USD accounts, so that you can send XE Trade Canadian dollars and have XE Trade deposit US dollars directly into the relevant account. Of course, if you want US cash you’ll still have to go to your bank to withdraw the money after it was deposited. (And in the spirit of being obvious, if you’re paying USD expenses electronically, you don’t require the extra step of going to your bank.) Also, it takes a few days between initiating the transaction with XE Trade and having the US dollars back in your account.

You also have to provide XE Trade a lot of personal information in the sign up process, as detailed below. You do not have to provide any information to face-to-face money changers.

Therefore, for small transactions, it is arguable as to whether it is more convenient to use XE Trade and if not, whether it is worth the small savings. Higher volume and dollar amount transactions for business can more easily see the benefits!

Generally, however, XE Trade works about as well as can be expected by an online, third party currency exchange service. Each person’s needs and preferences will determine whether XE Trade is worth using.

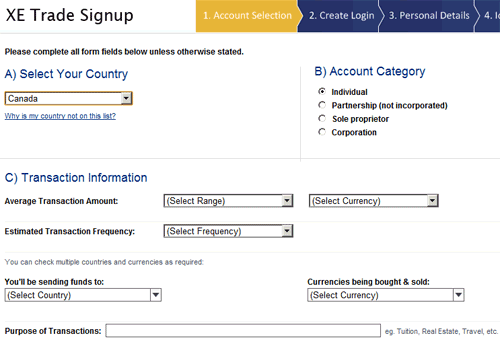

Signing up

The signup process is straightforward and quick, although you have to provide a lot of information, comparable to the amount of information that is required when you are opening a new bank account. In addition to basic name, address, and other contact information, you have to state the reason for which you will be using the service.

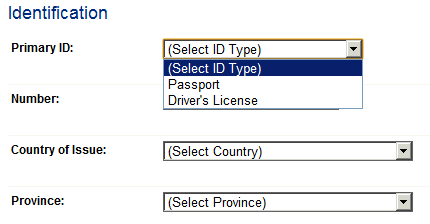

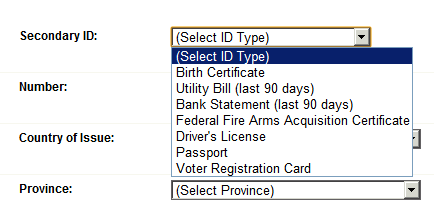

You also have to provide 2 pieces of identification, including at least one of a passport and a driver’s license:

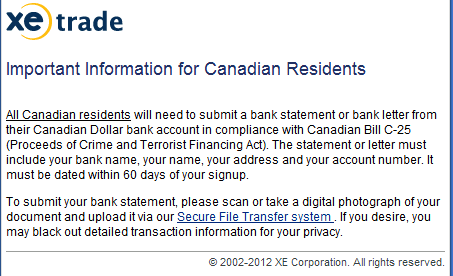

For Canadian residents, you also have to submit an electronic copy of a recent bank statement:

You then have to wait for your new account to be approved, although in my case this happened the same day.

Making a trade

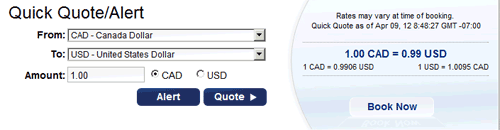

At any time, you can get a current rate quote before making a trade. The rate is changes in real-time, although once you’ve started the process of making a trade, the rate is held for 40 seconds and locked in when you’ve placed the bid (before sending any money).

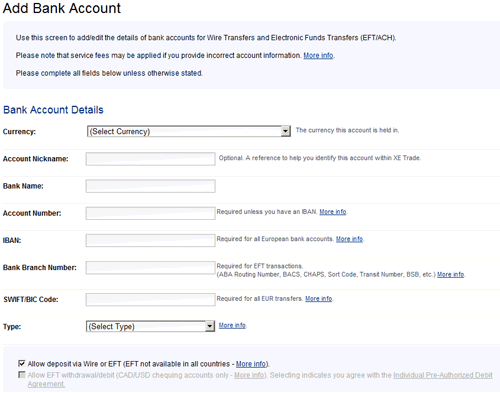

Before starting a trade you’ll want to set up your recipient bank account. This is quite simple, you just have to enter the bank information, account number, and transit number.

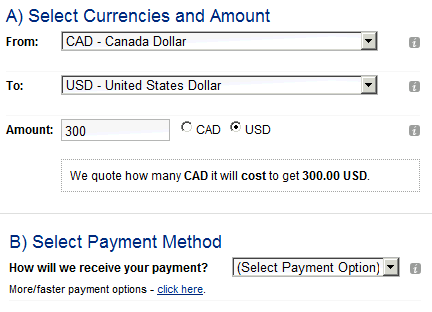

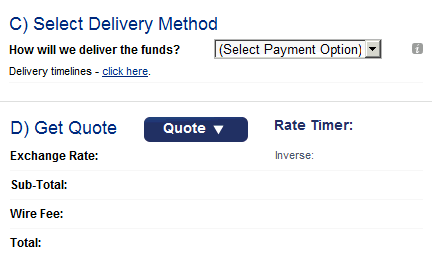

Then, you can set up the trade by entering the amount to trade, the source and destination currencies, your payment method, and the delivery method:

The delivery method can be a wire transfer or electronic funds transfer (EFT), both being free on the XE Trade end, and the latter being more likely to be free on the receiving bank end.

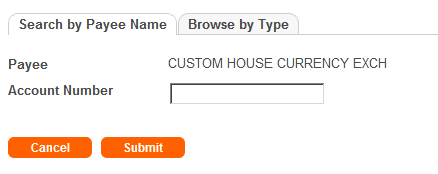

As for the payment method, you can choose “Wire” and then pay via your bank’s online bill payment service, selecting “Custom House Currency Exchange” as the payee and using your XE Trade account number.

Timeline

The following is the timeline that it took for me to sign up with XE Trade and complete and entire exchange:

- Day 1, morning: Registered for an account.

- Day 1, mid-afternoon: Account was activated.

- Day 2, morning: Submitted a trade and made a bill payment to send the money to XE Trade

- Day 3, morning: Informed via e-mail that XE Trade had received my Canadian dollar payment and sent the US dollar equivalent.

- Day 5, mid-day: US dollars showed up in my account, although dated Day 4, presumably due to some internal routing at the bank.

2015 update: Consider also CanadianForex, which I have now reviewed.

Facebook

Facebook Twitter

Twitter Email this

Email this keung.biz. Hire my web consulting services at

keung.biz. Hire my web consulting services at  Follow us on Twitter

Follow us on Twitter

May 9th, 2012 at 7:21 pm

Rodeworthy says:

Hi Peter,

I was fascinated to read your piece about XE trade. It sounded eerily the same as a service I use. Not until I read near the bottom I realized that it is the same. I set up an account with Custom House a few years back. Shortly after they were bought out by Western Union. When I access my account I am looking at WU tools.

We travel several months a year in the USA and this is the best possible way I have found to buy $US. It is fast, convenient and cheap. I watch the exchange rates and top up when they are favorable. You are correct — the setup process is extensive but worth the trouble.

Thanks for letting us know there is a company providing this service with an online presence. I have sent the reference to friends who are interested in the service.

May 23rd, 2012 at 8:15 am

Ron Canada says:

I compared XE Trade with TD online bank with a Canadian to U.S funds exchange for a $5000 exchange. XE Trade was $4.00 less. Not worth the hassle.

May 23rd, 2012 at 9:29 am

Charles Lampi says:

I have been using XE Trade for 3 years without any glitches. 5 days for transaction to be complete. On line from anywhere anytime. I generally flip $3000 whenever needed. Wire fee is $15 Canadian and entering my US account my bank charges $12 US. No need to declare any cash at the border especially when amount is over $10,000 it can be frustrating. No hassle and that is worth something.

June 14th, 2012 at 8:44 pm

chris says:

I’ve been using the service for several years, and it really is worth the hasstle of signing up. Everytime i have made a comparison, I find XE -trade to have the best exchange rates. And the money gets transferred from my BMO Cdn account into my BMO US account with no fees. Can’t get easier than this – really recommend it. Also I find the customer service really good. They are very quick to respond to questions or issues or requests. Very approachable on the phone. I have no connection to this company, but am providing this (for me, rare) review because they are one of the few financial service firms that actually are good to deal with. thanks

July 17th, 2012 at 5:37 am

David says:

I am writing to share my experience with XE Trade. I am not a happy customer.

1) XE Trade says they are the experts in the field of money transfers within countries. But, do not rely on XE Trade to know everything about exchanging money to send to every country in the world… Brazil, for example.

2) I relied on XE Trade to give me the great exchange rate they promised; to take the money out of my Wells Fargo Bank Account in the US; to exchange the US Dollars to Brazilian Reais; and to make the transfer to Brazil.

3) If XE Trade were, in fact, the reliable experts they say they are, they would have known that all money that arrives in Brazil is automatically changed to US Dollars (because that is the currency Brazil considers the International Currency). At any rate, any money from any country in the world that gets to Brazil is changed to US Dollars at the Central Bank in Brazil before anything is done with it.

4) By XE Trade exchanging my US Dollars to Brazilian Reais, they kept out their "fee" for making the exchange that is part of their rate. Then, when the money arrived in Brazil, Brazil, it arrived to be accepted into the bank and was changed to US Dollars… so that the Central Bank could exchange it to Brazilian Reais. The government of Brazil wants to be in control of the money… and the government of Brazil wants its cut of the funds coming into the country. Not a pretty picture, but true.

5) XE Trade purports to be the exerts at exchanging money and getting it wired to the country of choice… but if they were the experts, they would have known that transferring money to Brazil is handled this way.

6) In using XE Trade to do my transfer… and relying on them to save me money… it cost me several hundred dollars extra by the time the money had been exchanged back and forth twice. The XE Trade customer service representative apologized and said they would refund the difference and make me whole… but that was the last communication from them two months ago, and they now have no clue about the funds I transferred.

7) Beware. If something sounds too good to be true, it often is. This one stop shop named XE Trade is not for everyone… sending money to everywhere. Do your research before you use them. I spoke to XE Trade before even beginning the transaction, and the either lied to get my money (which took a WEEK for my money to get to my bank account in Brazil), or they simply didn’t know what they were doing. By the way, for a Wells Fargo fee of $45, the money leaves my Wells Fargo account… and arrives in my Itaú account in Brazil in less than 18 hours. Now that’s service! I don’t know what I was thinking… except to try and save money on the exchange rate… and that didn’t work at all.

July 17th, 2012 at 5:46 am

David says:

I left something off my previous post…

XE Trading also charged a Wire Transfer Fee on top of everything else. They said it was a fee that Brazil charges at their bank… and they have to collect the funds prior to making the transfer.

Well, guess what? The Central Bank does NOT charge a fee for incoming Wires. In fact, the lady at the bank in São Paulo called it nothing more than theft on the part of XE Trading.

October 22nd, 2012 at 1:01 am

xeisbad says:

avoid XE.com lately they have poor rates the banks offer better rates, sorry but xe.com is just not competitive anymore. Fastest way to cross XE.com is using bill pay or bill payment entire transaction is a 3 business day process but the rates are so bad that it isnt worth it

October 22nd, 2012 at 1:09 am

examplewhyxeisduppin says:

Xe also misrepresents their rates, website vs actual rate you buy or sell at,

here I am taking 10k USD and turning it to CDN as of today Oct 22 2012

ex

10000.00 USD = 9809.69 CAD 1 USD = 0.9810 CAD 1 CAD = 1.0194 USD on xe.com actual bid quote

on xe.com actual website

10,000.00 USD = 9,943.08 CAD

US Dollar ↔ Canadian Dollar

1 USD = 0.994308 CAD 1 CAD = 1.00572 USD

bunch of nonsense sorry xe you are duping consumers with good rates on your website then when u want to run a quote you give worse rate

AVOID XE!

December 19th, 2012 at 10:47 pm

cy says:

hi, examplewhyxeisduppin :

if market rate 1 USD = 0.9810 CAD . but you actuall bid is 1 USD = 0.994308 CAD. it’s impossbile since it’s better than market. or actual rate just for CAD to USD only?

February 23rd, 2013 at 11:12 am

Steaklover says:

In ten years of dealing with XE / Custom House – I have never had a transaction that would have made me feel I was dealing with a shady company. XE has been competitive in terms of rates but all the customer service has been sent to the Philippines and Lithuania. Nothing wrong with that in so far, since it is a global company. But the problem is, that you cannot understand them well enough. For a foreigner of North America – they have very good English but when you are dealing tens and hundreds of thousands and bank account numbers etc, it is imperative that everyone is understood without strain. When you are only having social discussions – than foreign accents are intriguing but not so much business dealings over the phone. More than that is that you will never have a relationship with this company. It is all based on departments, money and numbers. Sad truth. I used to have my person that I dealt with and got to know. That’s history. Good company and good service but the issue remains.

June 5th, 2013 at 2:48 am

FrenchResidentEnglishman says:

I have been using XETrade for about 4 years, since my income is in GBP paid into my UK bank. The best way used to be my Nationwide Debit Card (for US readers, NW is a mutual, but also the biggest mortgage lender in UK) which allowed hole in the wall extractions for no extra charge over margin. They changed, so I had to find alternative and came up with XET. I have my habitual method for this. I open two windows. First shows spot interbank rates, the other shows the quote window of XET. I have never had a quote which is more than 1.1% over spot.

My first trade ended up with a charge which mysteriously appeared. It was a charge levied on XET by my receiving bank here in France. Having realised that, I changed the method of transfer to be simple wired funds in both cases and I incur no charges.

I hate reading reviews by people who blame suppliers or vendors for errors which are essentially of their own making. @David had a vested interest in knowing how money transfers were handled for Brazil and should have acted accordingly. As an IT expert, I know just how much the system would be compromised if it tried to take account of every country in the world and every bank tariff. All banks have policy for how they handle incoming money and it is liable to change at any moment.

Having sorted my matters, I have forgotten the details, but I seem to remember words of help and advice available warning customers to be aware of source and destination regulations.

Caveat Emptor.

February 16th, 2015 at 1:45 pm

Danyliw says:

Feb.16,2015 I made a eft on Jan.30,2015 with XE trade for $1000 Canadian to US $,I’m still waiting,I called on two occasions, there located in Europe, not in BC Canada ,all they are telling me that there investigating.

April 29th, 2016 at 3:22 pm

Hary says:

XE is a waste of time. expensive and long delays. if THEY make a mistake in applying you have to do the application over again. have better things to do with my time, like make money.

August 2nd, 2016 at 10:05 pm

Christopher says:

XE is a waste of time, it took me 4 days to sign-up for XE and while my case may not be regular they gave me a worthless rejection, saying only "A business decision we can’t accept your account and it’s now closed". The fact that I’m a US expat and just trying to make it easy to pay my condo every month. They couldn’t figure out that I own two homes and resident of both countries, as well as sometimes making international purchases. If they had taken the time to actually have someone with a brain review my profile, they would have seen I have a strong personal and business profile. Just tossing my $0.2c in the mix so people know to look elsewhere 1st.

November 3rd, 2016 at 12:28 pm

Pat says:

I’m a Canadian living in the UK. I use xe to move money to Canada every month for the past 18 months. The rates are good – forex is a little better but not worth the hassle for me to open another account. I used to use xe when I lived in Canada to send money to a US account, again it worked well and no issues at all. Very convenient and I never wire, always use EFT which is free from my UK bank account to my Canadian.

September 20th, 2018 at 4:22 am

Jeff ivens says:

Not easy to transfer